Forecast for March 25th, 2011

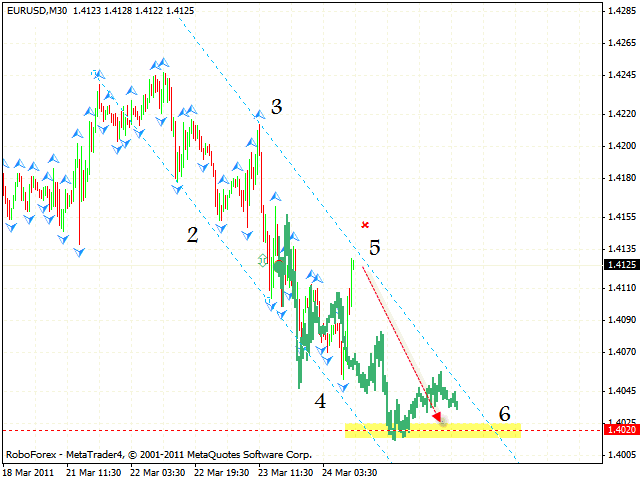

EUR/USD

The EUR/USD currency pair has reached all the targets of the reversal pattern. However, it keeps moving downwards and we should expect the price to fall into the area of 1.4020. One can consider selling the pair with the tight stop above 1.4150.

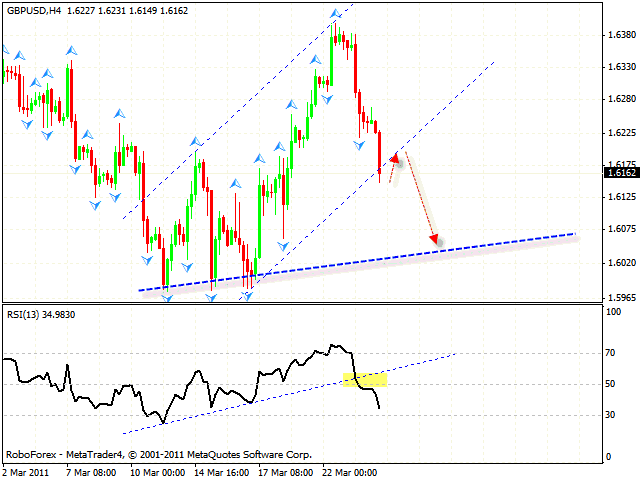

GBP/USD

Pound also started moving downwards with the target of 1.5755, and now the pair is inside the rising channel. The RSI indicator has broken the rising trend’s line, we can expect the test of the similar line at the price chart. We should expect the pair to fall to the level of 1.6030. One can try the tight stop sales.

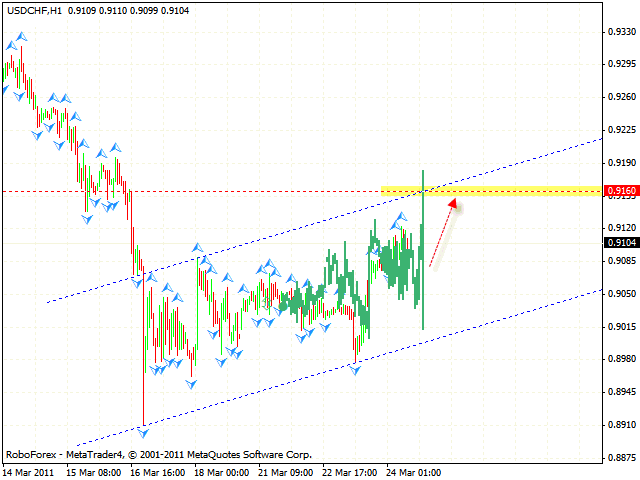

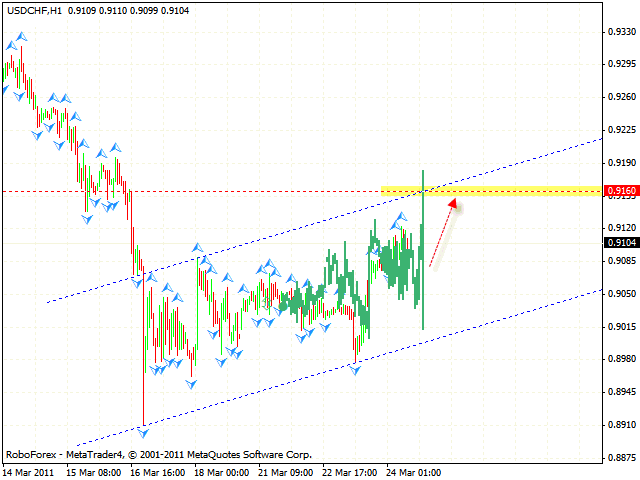

USD/CHF

In case of Franc the target of the growth is the area of 0.9160, the channel’s upper border. One can try to buy the USD/CHF currency pair with the tight stop. But if Franc falls lower than 0.9050, this case scenario will be cancelled and we will recommend you to close long positions.

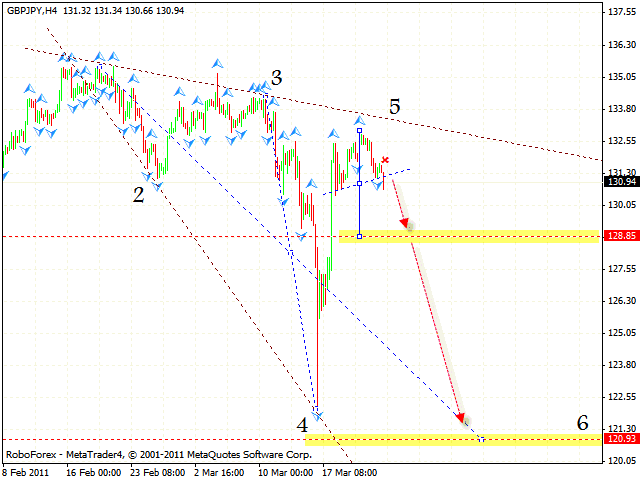

GBP/JPY

The GBP/JPY currency pair started moving to the area of 120.90. “Head & shoulders” reversal pattern has been completely formed by now and we should expect the price to fall to the level of 128.85. The stop must be above 131.70.

http://www.roboforex.com/